ABSTRACT OF PRESENTATION 2024

PRINCIPLES FOR PRESENTATIONS

2024: WILL PRICES STAY HIGH?

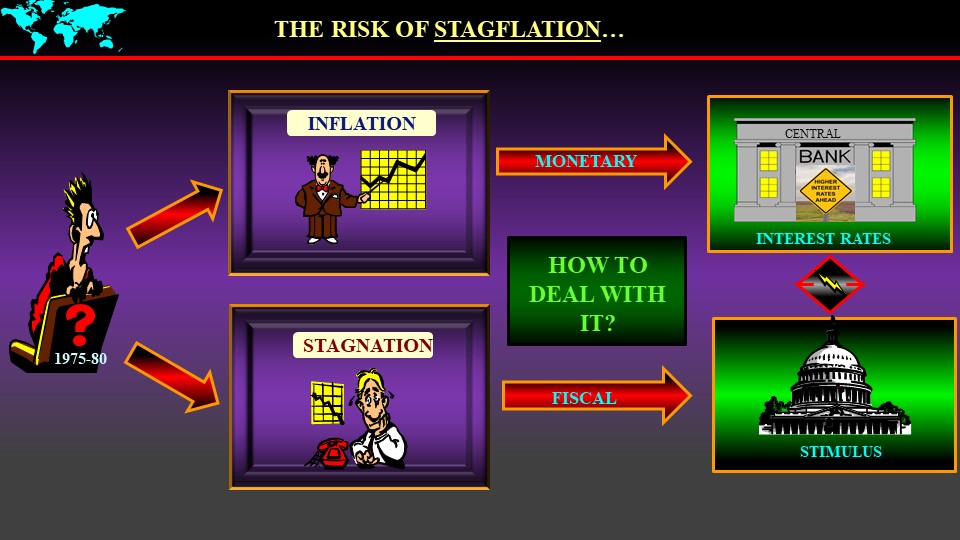

For the first time since the 1970s, the world economy simultaneously runs the risk of enduring Inflation and an economic slowdown.

However, central banks, mainly in the US and Europe, continue to target the fight against Inflation as their main priority. By raising interest rates aggressively, they have accepted the risk of bringing the economy to the brink of a recession. They hope that a temporary slowdown of economic activity will lower the pressure on imported energy and commodities prices. For the moment, they consider that employment seems unaffected and that consumers have an excess of savings built up during the Covid pandemic.

On the other hand, governments will continue to shelter consumers through generous subsidies to protect them against the hardship of energy or price increases. The resulting increased debt is an issue pushed to the future. A mindset of being assisted "at any cost" is developing in many countries.

The problem is that the central banks' and many governments' policies are incompatible. This dilemma runs in the background of all public decisions in 2024.

LOWER INFLATION DOES NOT MEAN LOWER PRICES

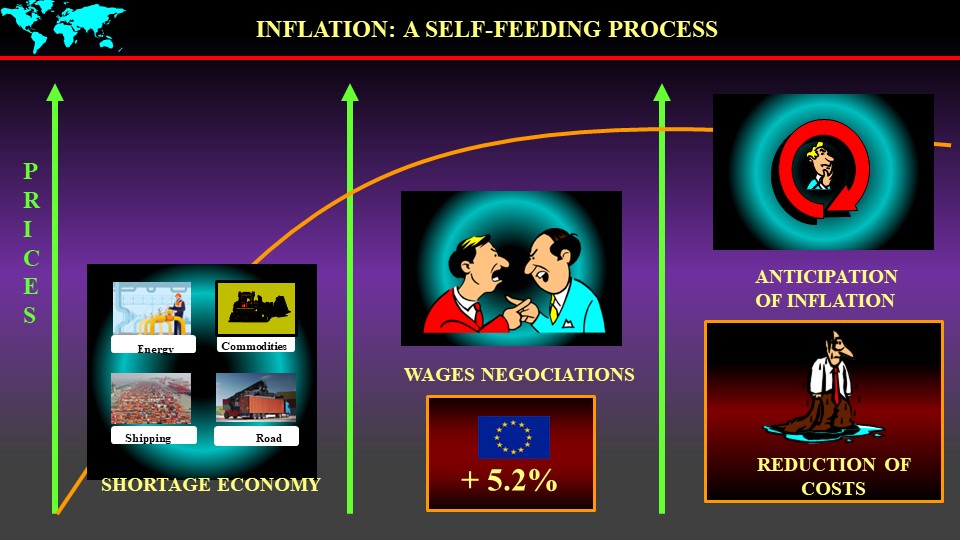

Inflation is an acceleration process. However, when the increase stops, it does mean that prices will recede in proportion.

Enterprises hope that energy, commodities and transport cost will stabilize. The expectation that the supply chain will be reliable again is as important as cost. Most companies have included higher prices in their budgets, but they will focus on the security of delivery.

In Europe, Inflation was triggered by higher energy prices. In the US, it was also fueled by a very accommodative monetary policy that flooded the market with liquidity.

However, experience has shown that when the initial causes of Inflation have disappeared, other mechanisms take over. It will be wage increases, seen as a means to combat the loss in purchasing power. Consequently, companies will focus on passing the cost increases to customers, if they can, or implement cost-cutting strategies.

Unfortunately, when everybody cuts costs simultaneously, it is not good news for the economy in general. An excess in thrift is just as bad as an excess in spending.

NEW CHAPTERS IN THE BOOK OF GLOBALIZATION

The "Golden Age" of globalization (1978 – 2018) was characterized by establishing a unified global market with cost-efficiency and high profits. It could be summarized as "Just in Time". Every nation could focus on what they do best according to the law of comparative advantages.

However, it also leads to an excess of specialization. Vulnerability and overdependence became a significant concern, both politically and economically, reinforced by the hardship of the Covid crisis.

A new chapter in globalization thus emphasizes the decoupling of economies and duplication of technologies. The aim is to reduce the overdependence on supplies from other nations. The objective is to develop a "Just in Case" model, more secure, more resilient, and more expensive.

Although more predictable, this approach means higher operating costs for companies since efficiency is not the only priority in the new business model. It will imply a rethinking of the location of supplies, sometimes back closer to the home market.

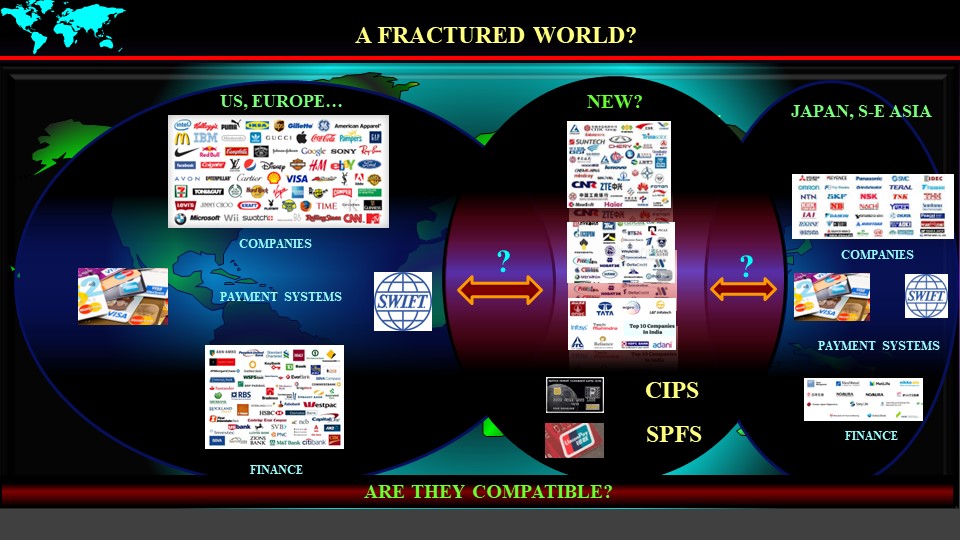

A FRACTURED WORLD?

The next stage in the "deglobalization" of the world economy seems to be a fractured world. Although nations will continue to depend on global trade and investment, they will aim to do it on their own terms. It implies developing an independent operating platform (for example, for financial transactions besides SWIFT) and business rules.

Fundamentally, the rules for accessing their domestic markets, as well as those to resolve conflicts with foreign enterprises, will be defined and implemented by local governments. It means a proliferation of sometimes conflicting operating systems that significantly complicate business decisions.

In the end, it may weaken the multilateral system set up during the past decades. Conflicts will not be resolved by trusted international organizations but by direct discussions among states. Access to markets can be jeopardized. Smaller nations, or those with less political clouts, risk being excluded from decision-making and subjected to new rules.

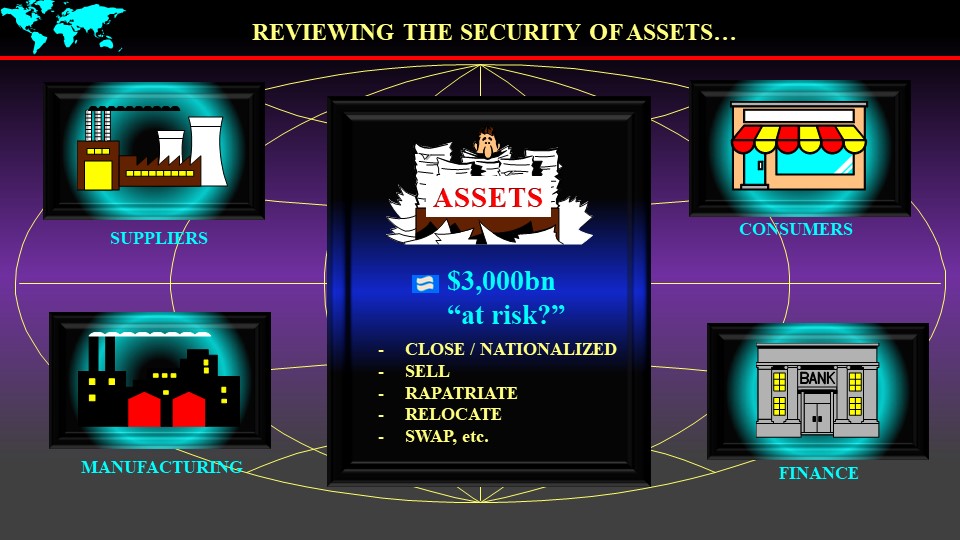

REVIEWING THE SECURITY OF ASSETS

In such a "fractured" world, companies are reviewing the security of their overseas assets.

During the golden age of globalization, the gold standard was 100% ownership of investments abroad. They would allow complete control of the strategy, global coordination of the value chain, and intellectual property protection.

However, the new age of globalization implies that assets abroad can be threatened by geopolitical conflicts, political interference or growing economic nationalism, also in the home country.

Companies need thus to assess the vulnerability of some investments. The most extreme case will mean exiting a country or selling to a local partner. Otherwise, joint ventures and other forms of partnership can be investigated. In the end, some barter activities could be resurrected.

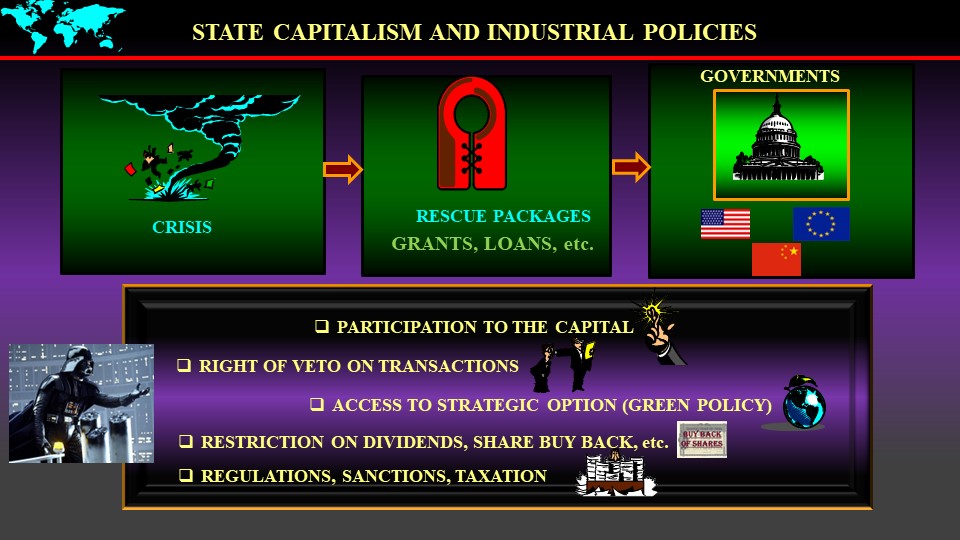

STATE CAPITALISM AND INDUSTRIAL POLICIES

Governments have stepped in during the economic crisis and made considerable money available to save companies. In addition, the geopolitical balance has changed, and political pressures have resulted in more industrial policies. The "empire" strikes back.

Consequently, governments have added stringent conditions to their support, such as influencing strategic options or preventing the distribution of dividends and companies' acquisitions.

Moreover, in the next stage, they are reinitiating traditional industrial policies. The security of supply for energy, commodities and critical technologies takes precedence over the openness of markets. Every nation wants to control its energy sector and production facilities in technologies such as semiconductors, electric vehicles, climate transition or medical.

As a result, industrial policies lead the stage to protectionist measures based on subsidies, preferred market access, buy national policies or national security dimensions.

Trade wars are the risk. In such a case, companies are always the hostages, then the victim, of political debates on the economy.

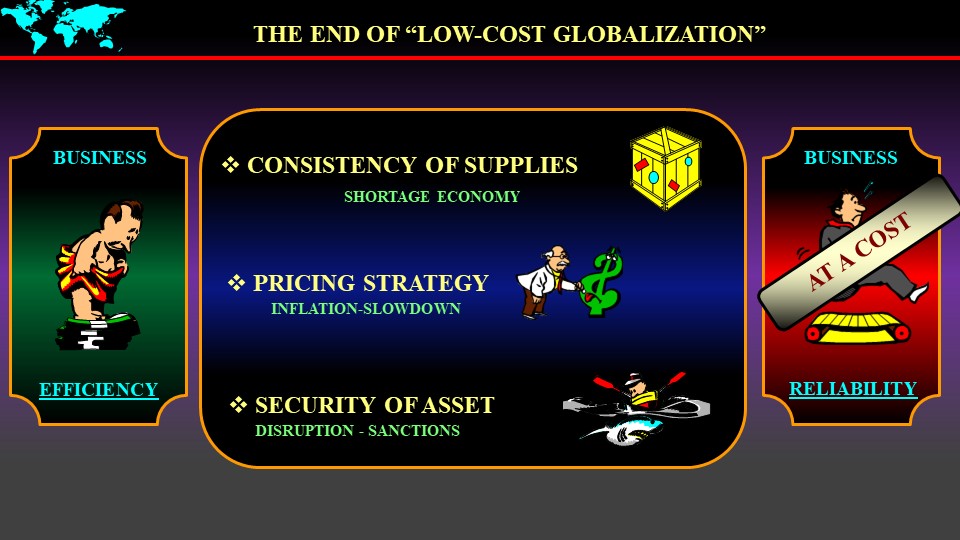

THE END OF LOW-COST GLOBALIZATION?

During the past 30 years, globalization has brought significant efficiency, a vast product supply, and low inflation to the world economy.

However, today, the shortage of supplies, bottlenecks in delivery, wage increases, and inflation indicate that low-cost globalization has reached its limit. In addition, the harmonization of global taxation and the proliferation of regulations will significantly increase the cost of doing business.

A new business model emphasizes the security of supply and resilience over price competitiveness. Reliability is becoming the name of the game.

To summarize, companies should be.

- Resilient: it is not what happens to you that matters but how fast and well you can respond to events, especially disruptive ones.

- Resourceful: it is the ability to gather many different but complementary resources – technology, finance and human – inside and outside the company and reach a common goal.

- Reliable: in a world where prices are likely to remain high, companies should focus more on the reliability of their relationship with partners and clients than on cost efficiency.

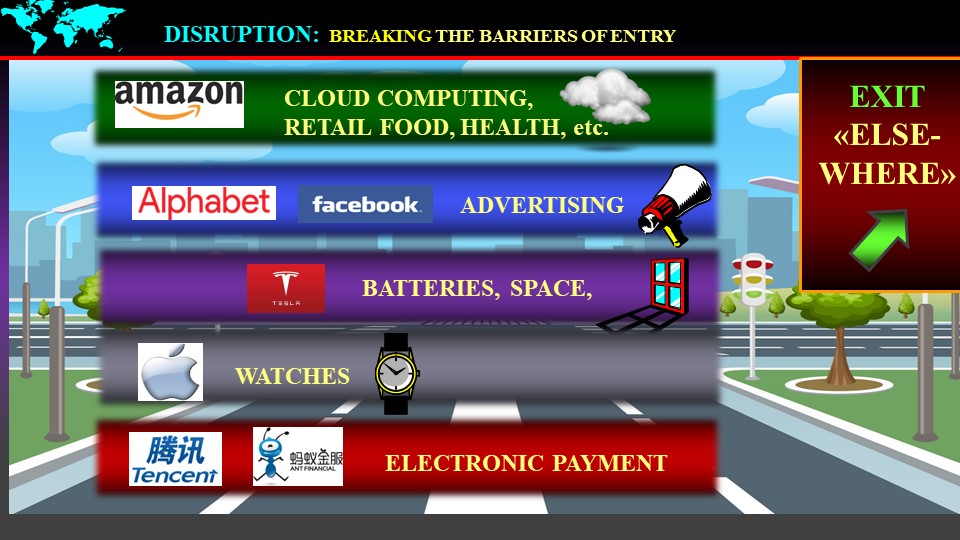

TECHNOLOGY COMPANIES ARE BREAKING THE ENTRY BARRIERS

Global technology companies can extend their business reach far beyond their initial industry sector.

Amazon is a world leader in cloud technology and is diversifying into food retail, health care, financial payment, etc. Google and Meta are leaders in digital advertising, Tesla in batteries and solar panels, and Apple now produces more watches than the Swiss watch industry.

The entry barriers in many businesses are thus falling and can also affect public institutions, for example, in the case of the creation of digital money.

In addition, their power raises the question of who should control what. Can powerful social media such as Twitter be managed independently of public control?

A political debate arises on the possibility of splitting large companies – for example, between the platform and the services – as it was done in the past in the US for oil, telecommunication and banking conglomerates.

The challenge for companies remains: who will be my competitors tomorrow, and where will they come from?

A BLACK HOLE ECONOMY?

A few large companies concentrate technology and financial power. The market capitalization of the ten largest global technology companies is now more than the combined value of their equivalent in the banking and pharma sectors.

Technological giants do not only innovate, but they have also engaged in a strategy of buying promising start-ups, often above market value. They use about 25% of their financial resources to purchase successful innovative young companies worldwide.

Countries risk suffering the consequences of a massive economic black hole at the center of which highly successful technology companies attract and buy young companies using their enormous free cash flow.

Thus, many nations could now lose promising young companies, which would have had, otherwise, the potential to become competitive national champions creating employment and paying taxes.

NEW BUSINESS MODELS

New business models flourish and take advantage of innovative technological platforms. The "free" model offers services as a counterpart to accessing personal data (Facebook), the "subscription" model locks consumers into a long-term relationship (Spotify). The "licensing" model only offers the use of a product, but not its ownership (Microsoft, Netflix).

The "circular" model (Ikea) allows consumers to bring back a product at the end of its life cycle and to exchange it for a new one (at a cost…). Finally, the "sell it yourself" model empowers people to sell directly using an existing platform (Amazon, eBay, Alibaba).

These business models change the relationship between companies and consumers. One objective is to lock consumers in a proprietary relationship, providing an ecosystem of products and services.

In short, "you have the choice, provided that it is me."

However, there is always a tangible product at the end of the value chain. One does not eat a bitcoin or drink a podcast.

CONSUMERS HAVE THEIR OWN PRIORITIES

Consumers are not passive and force new business models upon companies.

The circular economy is one example of how consumers force companies to introduce sustainability and environmental protection in their value chain and business proposition. It is part of a more significant movement advocating ESG (Environmental, Social, Governance) policies. Companies should consider society's priorities for broader issues such as climate change, transparency or ethics.

More precisely, the security of products (through certification processes, including health and sanitary standards) and transparency will gain importance.

Consumers will be adamant about better knowing and monitoring how a product is manufactured and distributed until it reaches them. And they will hold companies accountable for managing this new value chain approach.

THE COMPANY OF TOMORROW

The company structure of tomorrow will be hybrid, combining the different new requirements of clients, employees and governments.

More employees will want to work in the periphery of companies, combining the requirements of business and the aspiration of a better work-life balance. Such a model raises many uncertainties, especially in maintaining a coherent corporate culture where people feel they are treated equally regarding decision-making, promotion or reorganization.

If profit remains a fundamental objective, it must be combined with societal goals. Maintaining an appropriate balance between these two sometimes conflicting objectives will be the biggest challenge for business leaders in the future.

Consequently, such a multidimensional new structure will imply significant disruptions in the working attitudes of management and employees and will probably call for new competencies.

A YOUTHQUAKE?

The emergence of the millennials as consumers and employees forces companies to reassess their approach to products and markets

This new generation is driven by the following:

- "Meism", which is a self-centred approach to life,

- An eagerness for “transparency”, which means that nothing should be confidential;

- A willingness to “improve the state of the world”, primarily through sustainable development, biological diversity, energy transition, etc.

- A mindset that "free is cool", which implies a reassessment of profitability models for companies.

This new paradigm reinforces Peter Drucker's statement:

" Changes in society now have more impact on companies than changes in management."

A MINDSET FOR COMPETITIVENESS AND SUCCESS

This world competitiveness landscape implies new attitudes and new approaches to managing people. It is not only being good at "what you do" that counts, but also being good at "what you are."

Winners will need to deal with more uncertainty and a higher degree of discomfort. They should nurture a healthy sense of ambition for their organization and themselves. Resilience and the ability to quickly re-invent oneself are crucial to success.

Companies need to stimulate a mindset of imagination (why not?), of energy (why not now), and of commitment (why not me).

Companies are increasingly questioned, especially by the millennials, about their contribution to society, beyond their financial results. The “legality” of the actions of companies - conforming to the law - is no longer enough in a world where public opinion also demands "legitimacy" - adapting to a higher standard.

In such a world, companies will need to answer the broader question: "why us"?

TIME TO BE BOLD!

Therefore, the disruption of globalization should also be a time of reinvention for products, business models and work structures.

The winners are those who will identify the numerous opportunities in a fast-changing environment quickly. They will also implement their ideas faster than others.

The succession of crises that we are enduring (pandemics, war, etc.) will accelerate change and innovation in companies. It will also imply spending more time adapting to society's new expectations and employees' evolving mindsets.

In short, it is time to be bold!